XRP Price Prediction: Bullish Breakout Eyes $5.50 Target

#XRP

- XRP is trading above its 20-day MA, indicating bullish momentum.

- Recent partnerships and stablecoin developments are boosting market sentiment.

- Technical analysis suggests a potential breakout towards $3.12 and beyond.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

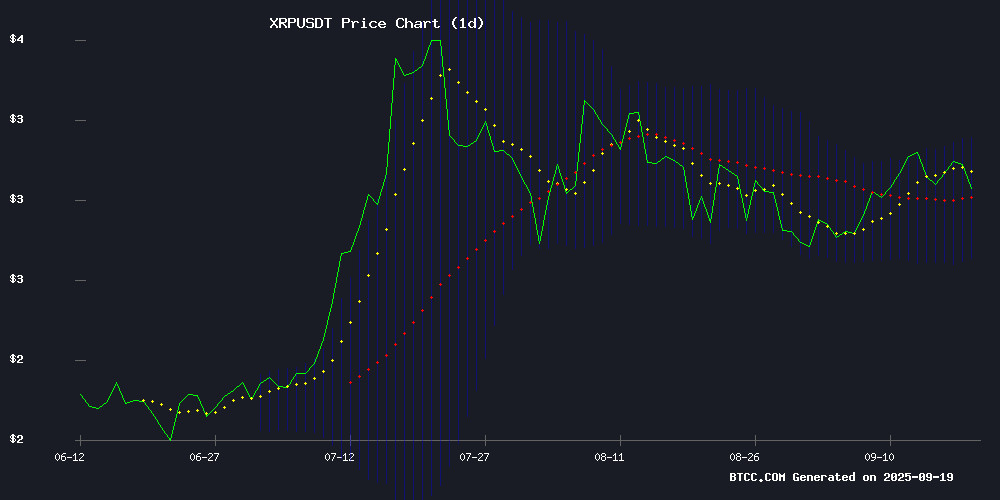

XRP is currently trading at $2.99, slightly above its 20-day moving average of $2.9456, indicating a potential bullish trend. The MACD histogram shows a slight bearish crossover, but the Bollinger Bands suggest a tightening range with upper, middle, and lower bands at $3.1763, $2.9456, and $2.7149 respectively. According to BTCC financial analyst Michael, 'XRP is consolidating NEAR key support levels, and a breakout above $3.03 could signal further upside potential.'

XRP Market Sentiment: Positive Developments Fuel Optimism

Recent news highlights significant developments for XRP, including the launch of an XRP-backed stablecoin protocol and Ripple's partnerships with Franklin Templeton and DBS Bank. BTCC financial analyst Michael notes, 'The market sentiment is buoyed by institutional interest and technical breakout potential. The $3 support level holding strong amid neutral funding rates is a positive sign.'

Factors Influencing XRP’s Price

Enosys Loans Launches XRP-Backed Stablecoin Protocol on Flare Blockchain

Enosys has introduced Enosys Loans, a Collateralized Debt Position (CDP) protocol on the Flare blockchain, enabling XRP holders to mint overcollateralized stablecoins without liquidating their assets. The system initially accepts FXRP and wFLR as collateral, with stXRP support planned for the near future.

The protocol employs a CDP model, where users lock assets to generate stablecoins pegged near $1. A stability pool manages liquidations and covers debt, while participants earn rewards from minting fees and liquidation proceeds. Pricing is secured via Flare's decentralized Time Series Oracle (FTSO), eliminating reliance on centralized data feeds.

Designed as a fork of Liquity V2, the protocol offers user-defined borrowing rates. Lower rates increase redemption risks if the stablecoin deviates from its peg. The upcoming integration with Firelight's stXRP will allow users to combine staking yields with stablecoin minting.

XRP Price Prediction: Ripple Eyes $5.50 Target as Technical Breakout Approaches

XRP shows signs of a potential rally to $5.50 by Q4 2025, with technical indicators flashing bullish despite current consolidation near $3.03. Analysts are increasingly optimistic, with Standard Chartered and CoinPedia anchoring their forecasts around the $5.50-$5.80 range, citing regulatory clarity and ETF potential as key catalysts.

Short-term projections remain cautious, with CaptainAltcoin anticipating a dip to $2.75 before upward momentum resumes. The most aggressive outlook comes from Ali Martinez, whose fractal analysis points to a $15.00 target—a 395% surge from current levels—should historical patterns repeat.

Critical levels to watch include immediate support at $2.70 and resistance at $3.38. A breakout above this threshold could confirm the bullish thesis, while a breakdown might delay the anticipated rally.

XRP Holds Key $3 Support Amid Neutral Funding Rates

XRP price demonstrates resilience above the $3 level, a critical bullish order block that now serves as high-time-frame support. The asset's ability to maintain this foothold reinforces its upward trajectory, with consecutive higher lows confirming a structurally sound market.

Neutral funding rates suggest balanced sentiment among traders, avoiding the overleveraged conditions that often precede sharp corrections. This stability sets the stage for a potential test of $3.55 resistance—a level that could determine whether XRP resumes its climb or enters a consolidation phase.

Ripple's institutional push gains momentum with the planned listing of tokenized money market funds and stablecoins on DBS Digital Exchange. The move signals growing acceptance of digital assets within traditional finance frameworks, potentially creating new demand channels for XRP.

Stablecoin Issuers Pursue Bank Charters as Regulators Propose New Limits

Stablecoin issuers are increasingly seeking bank charters in the United States, with Ripple applying to form Ripple National Trust Bank—a federal trust institution that could custody assets and potentially access central bank payment rails. The move signals a broader trend of crypto-native firms adopting traditional financial structures to gain regulatory clarity and operational flexibility.

Tether, the largest stablecoin issuer, plans to launch a U.S.-domiciled stablecoin called USAT, while DBS, Franklin Templeton, and Ripple collaborate to enable trading of tokenized money market fund shares. These developments bridge the gap between bank-grade cash equivalents and on-chain payments.

The Bank of England has proposed wallet caps of £10,000-£20,000 for individuals and £10 million for businesses holding systemic stablecoins. The limits aim to prioritize payment utility over large-scale savings, reflecting growing regulatory scrutiny of stablecoin adoption.

In the U.S., the path forward hinges on two key factors: the federal trust bank perimeter and potential Federal Reserve account access for issuers. Ripple’s trust charter would subject it to OCC supervision, fiduciary duties, and reserve requirements—marking a significant step toward institutional legitimacy.

Pro-XRP Lawyer Bill Morgan Explains XRP’s Circulating Supply Debate

XRP's circulating supply has surged to nearly 60 billion tokens out of a total 100 billion, sparking concerns about inflationary pressure and potential price dilution. Community members fear that increasing supply could weaken XRP's value, drawing parallels to traditional inflationary models.

Bill Morgan, a prominent pro-XRP lawyer, counters these concerns by highlighting the predictable nature of XRP's supply release. Unlike Bitcoin's mining-driven supply, XRP's distribution follows a fixed schedule—approximately 1 billion tokens per month. This structured approach eliminates sudden inflationary spikes, offering stability rather than volatility.

The debate underscores a broader tension in crypto economics: how supply dynamics influence investor perception. Morgan's intervention reframes the narrative, emphasizing XRP's transparency and scheduled scarcity over time.

XRP Supply Dynamics Spark Market Reevaluation

Ripple's XRP faces renewed scrutiny as analysts challenge conventional supply metrics. The cryptocurrency's reported circulating supply of 59.6 billion coins masks a more complex reality—XRPScan data shows 64.7 billion on-ledger, while Ripple maintains 35.3 billion in escrow. This structural opacity creates potential for supply shocks should demand accelerate.

Cheeky Crypto's analysis of 200,000 followers suggests available tradeable supply may be significantly constrained. The monthly release of up to 1 billion escrowed tokens creates a measured inflation schedule, but market participants appear to be pricing in tighter future conditions. Such supply mechanics could amplify volatility during periods of heightened adoption.

XRP Price Dips Despite Landmark ETF Launch as Market Momentum Fades

XRP edged lower despite the historic debut of the first U.S.-listed XRP ETF, with the REX-Osprey fund recording $37.7 million in inaugural trading volume. The token slipped 1.5% to $3.03, remaining rangebound between technical support at $2.95 and resistance at $3.18.

Market activity showed clear signs of cooling—spot volume declined 12.6% to $6.05 billion while derivatives turnover plunged 20%. The muted price reaction to the ETF launch suggests institutional adoption alone cannot override broader market lethargy. Traders appear to be sidelined, with open interest dipping 0.8% as participants await clearer directional cues.

While the 1940 Act-structured ETF provides regulated exposure for U.S. investors, XRP continues to trade 16% below its July peak of $3.65. The divergence between product innovation and price action highlights cryptocurrency markets' complex dynamics—where structural developments often precede measurable price impacts.

Ripple Partners with Franklin Templeton and DBS Bank to Pioneer Blockchain Repo Markets

Ripple has forged a transformative alliance with Franklin Templeton, a $1.5 trillion asset manager, and DBS Bank Singapore, marking a significant leap in institutional blockchain adoption. The collaboration targets the migration of repo markets onto blockchain infrastructure, leveraging stablecoins and tokenized money market funds as core components.

Franklin Templeton's sgBENJI token—a digital representation of shares in a USD-denominated money market fund—will anchor the initiative. Listed on a Singapore exchange, sgBENJI enables instant swaps with Ripple's RLUSD stablecoin, offering investors a seamless bridge between yield-bearing traditional assets and blockchain efficiency.

The partnership's second phase delves deeper into financial innovation, with Ripple spearheading the development of blockchain-native repo markets. This move signals accelerating institutional confidence in distributed ledger technology as a backbone for capital markets.

XRP Price Tests $3.03 as Ripple President Joins Senate Banking Committee

XRP trades at $3.03, down 1.08% in the past 24 hours, as regulatory developments and a $25 million RLUSD donation bolster long-term sentiment despite short-term weakness. Ripple's technical indicators show neutral momentum with an RSI of 53.24 and bullish MACD divergence.

Ripple President Monica Long's participation in the U.S. Senate Banking Committee's roundtable on crypto market structure marks a significant step in the company's regulatory advocacy. This follows Ripple's $25 million investment in RLUSD tokens to support small businesses and veterans, showcasing real-world utility and fostering positive regulatory relationships.

While these developments have yet to spark a price surge, they strengthen XRP's fundamental outlook by addressing regulatory clarity and ecosystem adoption. The market remains in consolidation, with mixed signals suggesting cautious optimism.

XRP Bulls Target $3.12 Break as Technicals Signal Upside Potential

XRP is gaining bullish momentum after consolidating near the $2.980 support level, with traders eyeing a decisive break above $3.120 to confirm further upside. The cryptocurrency has reclaimed the $3.020 resistance and now trades above $3.080, supported by a rising channel breakout and Fibonacci retracement levels.

Market sentiment aligns with broader crypto recovery trends, as Bitcoin and Ethereum also rebound from recent dips. The 100-hourly SMA provides a technical floor, while the 50% Fib level of the $3.185-$2.957 swing reinforces the bullish case. Liquidity above $3.120 remains the critical threshold for sustained upward movement.

Ripple Price Prediction As Spot XRP ETF Records Strongest Launch of 2025

The REX-Osprey XRP ETF (XRPR) has marked a historic debut, closing its first trading session with $37.75 million in volume—the highest day-one performance for any ETF launched in 2025. The fund, which holds physical XRP tokens, offers institutional and retail investors regulated exposure without the complexities of direct crypto custody.

XRPR’s volume outpaced all previous XRP futures ETFs within 90 minutes of trading. Analysts highlight the significance of this milestone, noting it surpasses even the $17 million debut of $DOJE, which would rank among 2025’s top five ETF launches.

Ripple’s recent partnerships with DBS Bank and Franklin Templeton further bolster confidence in XRP’s utility for cross-border payments. Meanwhile, the token’s price remains resilient, consolidating above key support levels after a sustained rally.

Is XRP a good investment?

XRP presents a compelling investment case based on current technical and fundamental factors. Here's a summary:

| Metric | Value |

|---|---|

| Current Price | $2.99 |

| 20-Day MA | $2.9456 |

| Bollinger Bands | $3.1763 (Upper), $2.9456 (Middle), $2.7149 (Lower) |

BTCC financial analyst Michael suggests, 'XRP's strong institutional backing and technical setup make it a high-potential asset, with a near-term target of $3.12 and a longer-term outlook of $5.50.'